Tax Cuts & Jobs Act (2018)

Tax Cuts & Jobs Act (2018)

The new tax laws may be beneficial to many of our clients. Below is a summary of key items.

2020 Tax Rates

Rates for Individuals including Pass-through income received by owners from Rental Property, Sole Proprietorships, Members or Partners from LLC's and Partnerships and Shareholders from S-Corporations

Single

$0 to $9,875: 10%

$9,876 – $40,125: $987.50 + 12% of the amount over $9,875

$40,126 – $85,525: $4,617.50 + 22% of the amount over $40,125

$85,526 – $163,300: $14,605.50 + 24% of the amount over $85,525

$163,301 – $207,350: $33,271.50 + 32% of the amount over $163,300

$207,351 – $518,400: $47,367.50 + 35% of the amount over $207,350

$518,400 or more: $156,235 + 37% of the amount over $518,400

Married Filing Jointly or Qualifying Widow(er)

$0 – $19,750: 10%

$19,751 – $80,250: $1,975 + 12% of the amount over $19,750

$80,251 – $171,050: $9,235 + 22% of the amount over $80,250

$171,051 – $326,600: $29,211 + 24% of the amount over $171,050

$326,601 – $414,700: $66,543 + 32% of the amount over $326,600

$414,701 – $622,050: $94,735 + 35% of the amount over $414,700

$622,051 or more: $167,307.50 + 37% of the amount over $622,050

Married Filing Separately

$0 – $9,875: 10%

$9,876 – $40,125: $987.50 + 12% of the amount over $9,875

$40,126 – $85,525: $4,617.50 + 22% of the amount over $40,125

$85,526 – $163,300: $14,605.50 + 24% of the amount over $85,525

$163,301 – $207,350: $33,271.50 + 32% of the amount of $163,300

$207,351 – $311,025: $83,653.75 + 37% of the amount over $311,025

$311,026 or more: $83,653.75 + 37% of the amount over $311,025

Head of Household

$0 – $14,100: 10%

$14,101 – $53,700: $1,410 + 12% of the amount over $14,100

$53,701 – $85,500: $6,162 + 22% of the amount over $53,700

$85,501 – $163,300: $13,158 + 24% of the amount over $85,500

$163,301 – $207,350: $31,830 + 32% of the amount over $163,300

$207,351 – $518,400: $45,926 + 35% of the amount over $207,350

$518,401 or more: $154,793.50 + 37% of the amount over $518,400

C-Corporation Tax Rate: 21%

The new tax laws may be beneficial to many of our clients. Below is a summary of key items.

2020 Tax Rates

Rates for Individuals including Pass-through income received by owners from Rental Property, Sole Proprietorships, Members or Partners from LLC's and Partnerships and Shareholders from S-Corporations

Single

$0 to $9,875: 10%

$9,876 – $40,125: $987.50 + 12% of the amount over $9,875

$40,126 – $85,525: $4,617.50 + 22% of the amount over $40,125

$85,526 – $163,300: $14,605.50 + 24% of the amount over $85,525

$163,301 – $207,350: $33,271.50 + 32% of the amount over $163,300

$207,351 – $518,400: $47,367.50 + 35% of the amount over $207,350

$518,400 or more: $156,235 + 37% of the amount over $518,400

Married Filing Jointly or Qualifying Widow(er)

$0 – $19,750: 10%

$19,751 – $80,250: $1,975 + 12% of the amount over $19,750

$80,251 – $171,050: $9,235 + 22% of the amount over $80,250

$171,051 – $326,600: $29,211 + 24% of the amount over $171,050

$326,601 – $414,700: $66,543 + 32% of the amount over $326,600

$414,701 – $622,050: $94,735 + 35% of the amount over $414,700

$622,051 or more: $167,307.50 + 37% of the amount over $622,050

Married Filing Separately

$0 – $9,875: 10%

$9,876 – $40,125: $987.50 + 12% of the amount over $9,875

$40,126 – $85,525: $4,617.50 + 22% of the amount over $40,125

$85,526 – $163,300: $14,605.50 + 24% of the amount over $85,525

$163,301 – $207,350: $33,271.50 + 32% of the amount of $163,300

$207,351 – $311,025: $83,653.75 + 37% of the amount over $311,025

$311,026 or more: $83,653.75 + 37% of the amount over $311,025

Head of Household

$0 – $14,100: 10%

$14,101 – $53,700: $1,410 + 12% of the amount over $14,100

$53,701 – $85,500: $6,162 + 22% of the amount over $53,700

$85,501 – $163,300: $13,158 + 24% of the amount over $85,500

$163,301 – $207,350: $31,830 + 32% of the amount over $163,300

$207,351 – $518,400: $45,926 + 35% of the amount over $207,350

$518,401 or more: $154,793.50 + 37% of the amount over $518,400

C-Corporation Tax Rate: 21%

Standard Deduction

This is the deduction that is automatically available to all resident filers. It increased significantly under the new tax law of 2018 and has become even more favorable for 2019. In most cases, this may make up for certain lost or limited Itemized Deductions.

2020 2019

Your Filing Status:

Single & Married Filing Separately $12,400 $12,200

Married Filing Jointly $24,800 $24,400

Head of Household $18,650 $18,350

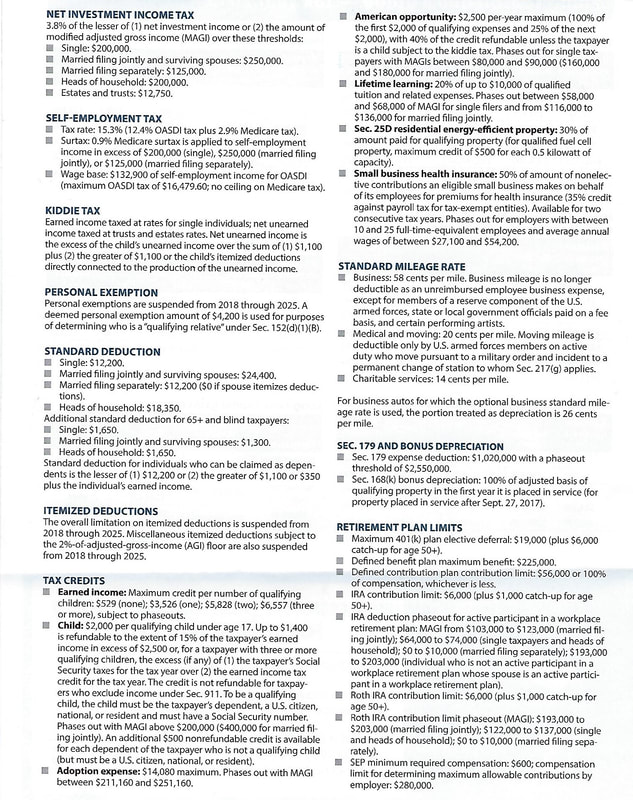

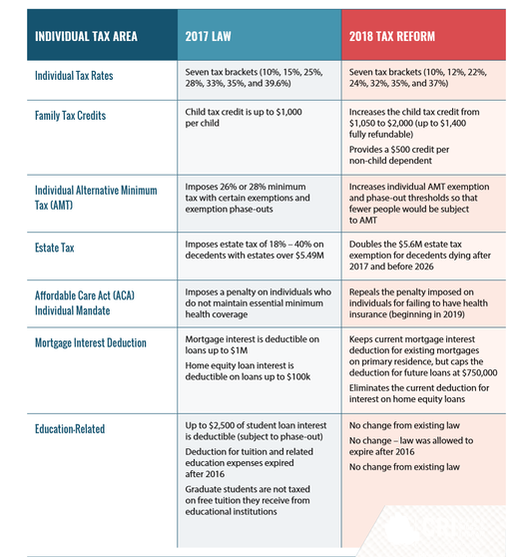

Other Key Changes of the 2018 Tax Law (current)

Below is a a summary of other key tax changes. Including increased IRA contributions and more favorable tax treatment of Family and Child Tax Credits, Earned Income Credit, Alternative Minimum Tax (everyone's most hated tax!) and Estate Tax.

NJ RESIDENTS - TAX DEDUCTION "WORKAROUND"

On January 13, 2020 - Law was passed in NJ to allow owners of business entities to pay their PERSONAL real estate and other property taxes from their BUSINESS accounts. This would make such taxes fully deductible. This is now a legal strategy in NJ to get around the $10,000 Federal limitation on State and Local Income Taxes. Our initial interpretation of requirements as it applies to taxpayers with nexus to NJ (reside or do business in NJ):

(1) You must own an entity that files separately, such as a mutli-member LLC or corporation.

(2) The workaround provision is mainly for property/ real estate taxes; therefore, you must own a home.

(3) Payments must be made from the business account.

CAUTION:

The law is aimed directly and without pretense at circumventing the existing Federal law, which limits the deduction of state and local income taxes plus property taxes to $10,000. However, note that the fact that NJ passed the law does not guarantee that the IRS will accept it without issuing countervailing guidance.

RECOMMENDED ACTION:

For now, we would not discourage you from following the NJ law if it applies in your case. The IRS has not yet opined. Should the IRS disallow such transactions via written guidance, we will make the necessary adjustments to comply with the Federal law. You will not loose the corresponding deduction allowed under Federal and NJ laws. At minimum, it may optimizer results of NJ income tax filing.

EXPECTATION:

The IRS has challenged prior attempts by states to create loopholes (remember the prior unsuccessful attempt to classify state income and property taxes as charitable donations). If successful, we expect other high tax states such as NY, CT and CA will follow soon thereafter.

On January 13, 2020 - Law was passed in NJ to allow owners of business entities to pay their PERSONAL real estate and other property taxes from their BUSINESS accounts. This would make such taxes fully deductible. This is now a legal strategy in NJ to get around the $10,000 Federal limitation on State and Local Income Taxes. Our initial interpretation of requirements as it applies to taxpayers with nexus to NJ (reside or do business in NJ):

(1) You must own an entity that files separately, such as a mutli-member LLC or corporation.

(2) The workaround provision is mainly for property/ real estate taxes; therefore, you must own a home.

(3) Payments must be made from the business account.

CAUTION:

The law is aimed directly and without pretense at circumventing the existing Federal law, which limits the deduction of state and local income taxes plus property taxes to $10,000. However, note that the fact that NJ passed the law does not guarantee that the IRS will accept it without issuing countervailing guidance.

RECOMMENDED ACTION:

For now, we would not discourage you from following the NJ law if it applies in your case. The IRS has not yet opined. Should the IRS disallow such transactions via written guidance, we will make the necessary adjustments to comply with the Federal law. You will not loose the corresponding deduction allowed under Federal and NJ laws. At minimum, it may optimizer results of NJ income tax filing.

EXPECTATION:

The IRS has challenged prior attempts by states to create loopholes (remember the prior unsuccessful attempt to classify state income and property taxes as charitable donations). If successful, we expect other high tax states such as NY, CT and CA will follow soon thereafter.